Nine months ago, Donald Trump inherited an economy that was "the envy of the world."

Today, that economy is a disaster.

According to Moody's chief economist Mark Zandi, as of September 1:

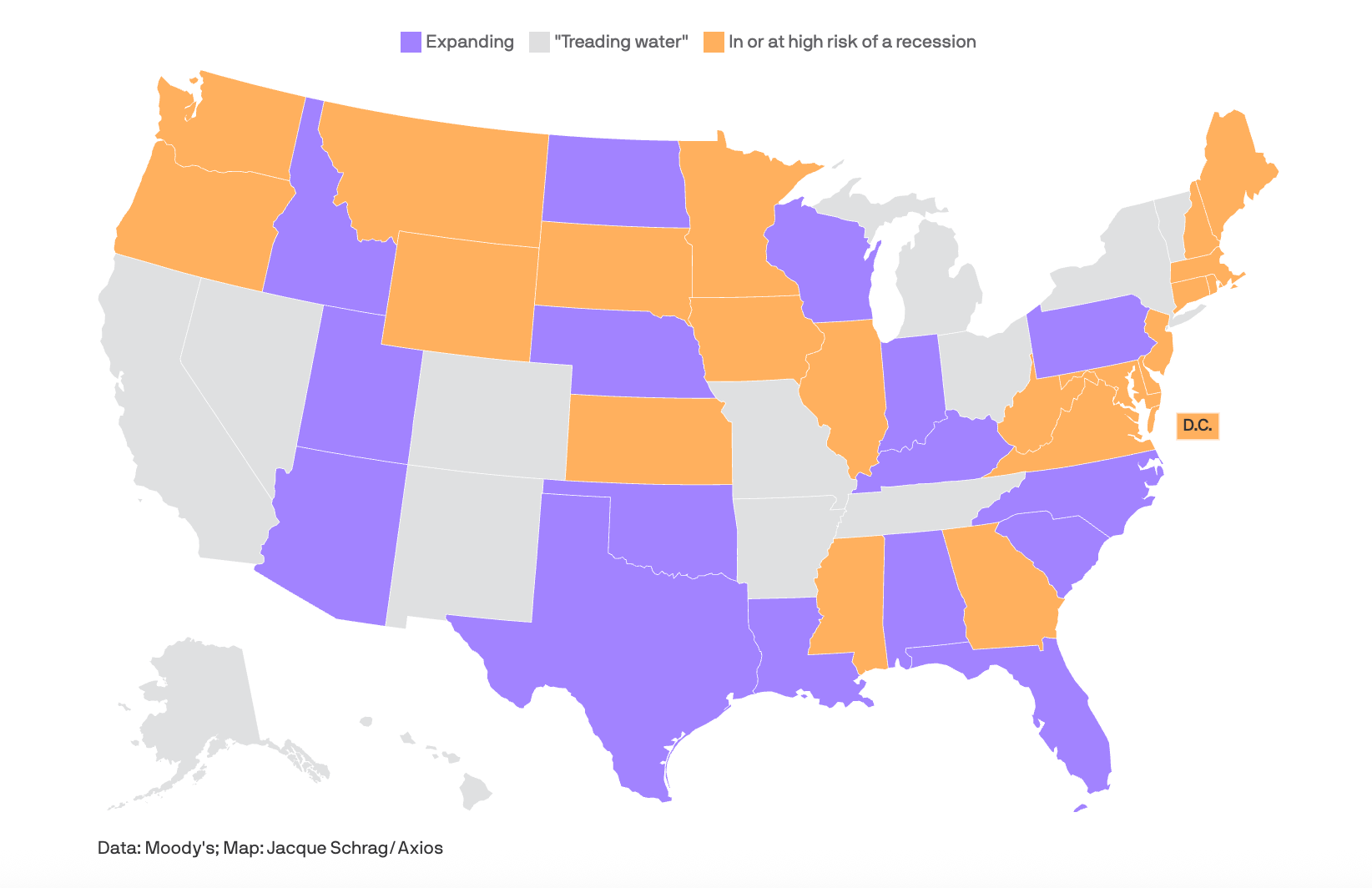

States making up nearly a third of U.S. GDP are either in or at high risk of recession, another third are just holding steady, and the remaining third are growing.

As Axios notes, the fate of major states like New York and California, which are now only "treading water" despite the AI-driven excitement in Silicon Valley and on Wall Street, could decide which way the national economy goes.

According to Axios:

The states most impacted are the ones more reliant on agriculture and manufacturing. Those sectors are more likely to be impacted by tariff increases, Zandi says. The immigration crackdown is suppressing growth as well.

And things are only getting worse.

Under Trump, the future looks bleak

Job growth has stalled.

Inflation is rising.

And the Trump government shutdown is highlighting to a nation already struggling with healthcare costs, just how devastating Trump's "Big Beautiful Bill" is about to become for millions of Americans whose ACA premiums are set to increase more than 100% under the current Trump plan.

Now, a new report from the National Foundation for American Policy (NFAP) highlighted by Newsweek is warning that Trump's "restrictive immigration measures could slow growth and widen federal deficits."

Writes Newsweek:

The NFAP estimates that cumulative GDP could fall by $1.9 trillion from 2025 to 2028 and by $12.1 trillion from 2025 to 2035. This represents a per capita loss of $5,612 by 2028 and $34,369 by 2035.

The analysis also indicates that these immigration policies could increase federal debt. The NFAP projects an increase in public debt of $252 billion by 2028 and $1.74 trillion by 2035.

These forecasts "do not account for additional spending on border and immigration enforcement," which could further strain federal finances.

As America gets weaker, Trump's money and power grab continues

While income inequality has created enormous wealth for the Top 0.1%, most Americans continue to face diminishing prospects in terms of career opportunities, home ownership, and wealth creation.

Overall, consumer confidence is plunging. And even though top-line data shows a "resilient economy," The New York Times reports that half of all spending is now driven by the top 10%, while the rest of the nation struggles.

Meanwhile, the same thing is happening on Wall Street, where the top 1% of the S&P 500 — the seven stocks known as the "Magnificent 7" (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla) — now account for more than one third of the value of entire index.

Especially concerning for those who believe the AI bubble will one day pop is the fact that future growth for the Mag 7 and OpenAI (the world's most valuable startup) is increasingly predicated on "circular deals" between the companies themselves. These deals, says Seeking Alpha, "create interdependencies that could amplify risks if AI investments fail to deliver returns."

Trump, of course, doesn't care about any of this.

He's more concerned about his own failing health than the failing US economy.

And he's fine with America becoming a Putin-inspired kleptocracy.

Just as long as he and his boys keep swimming in emoluments and piling up the crypto billions.

If you enjoy Unprecedented, please consider becoming a paid subscriber. All of my content is available free of charge but your support makes it possible. Thanks for reading.

Further reading: 32 ways Trump broke the economy.

Subscribe to Unprecedented

Subscribe to the newsletter and unlock access to member-only content.