Regular readers of this newsletter know that Trump's causing all kinds of crises for America.

But for once, it's not just me saying it.

As Diana Olick reported for CNBC today, sales of previously owned homes "tanked" in January, dropping "a much wider-than-expected 8.4% from December."

The chief economist for the National Association of Realtors, Lawrence Yun, is calling it "a new housing crisis."

After home sales recorded their biggest monthly drop since December 2022 and abruptly slowed to their slowest monthly pace in more than two years, Yun also told reporters that:

Potential buyers are "still struggling," and "renters are not participating in housing wealth." He characterized the current market as a crisis because, "the movement is not happening. Americans are stuck."

The Trump housing crisis isn't happening in isolation.

Home sales are plummeting amid an affordability crisis that Trump's tariffs have only worsened, a jobs crisis that's far worse than we knew last week—and a consumer debt crisis that has Americans falling behind on their bills at levels not seen in nearly a decade.

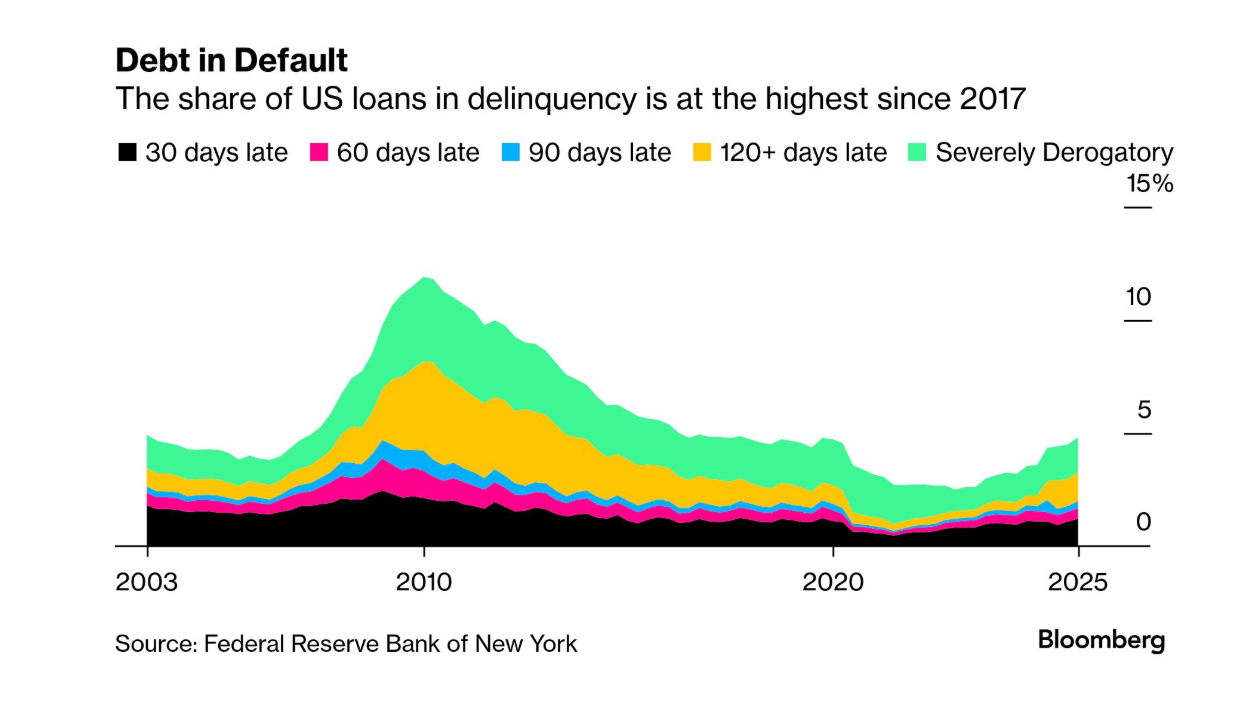

U.S. consumer delinquencies are surging

As Bloomberg reported this week:

Delinquency rates on loans ranging from mortgages to credit cards rose to 4.8% of all outstanding US household debt in the fourth quarter, the highest level since 2017, driven by rising defaults among low-income and young borrowers.

As Seeking Alpha notes, Trump has significantly worsened America's consumer debt crisis since making it harder for millions of Americans to dig out from under their crushing burden of student loan debt.

In Q4 2025:

- Outstanding student loan debt stood at $1.66T

- 9.6% of loans were more than 90 days delinquent

- One million borrowers more than 120 days past due had their loans transferred to the Department of Education’s Default Resolution Group

Trump, of course, doesn't see a problem here. The Dow hit 50,000. He wants you to believe the economy is "booming," even though it's harder than ever to get a job that enables you to buy groceries and pay your rent, let alone pay off your student loans.

And if you do fall behind in your student loan payments, Trump is taking aggressive steps to garnish your wages and destroy your credit record — setting you back years from the possibility of ever buying a home.

Thanks for reading and sharing! While paid subscriptions are always welcome, I’m continuing to offer all content free, so choosing a “free” subscription means you'll never miss an issue of UNPRECEDENTED.

To support this newsletter without subscribing, consider a one-time tip at Buy Me a Coffee.

Subscribe to Unprecedented

Subscribe to the newsletter and unlock access to member-only content.