It only took three weeks, but Trump's policies and rhetoric are already threatening to turn the "Biden Boom" into a "Trump Tailspin."

According to the Murdoch-owned Wall Street Journal: "The Trump bump in consumer confidence is already over":

Consumer sentiment fell about 5% in the University of Michigan’s preliminary February survey of consumers to its lowest reading since July 2024. Expectations of inflation in the year ahead jumped from 3.3% in January to 4.3%, the second month in a row of large increases and highest reading since November 2023.

“It’s very rare to see a full percentage point jump in inflation expectations,” said Joanne Hsu, who oversees the survey.

Friday's disastrous jobs report only added to the gloom.

Trump is making consumers and investors nervous

Heading into the November 2024 election, the US economy was "The Envy of the World" said The Economist.

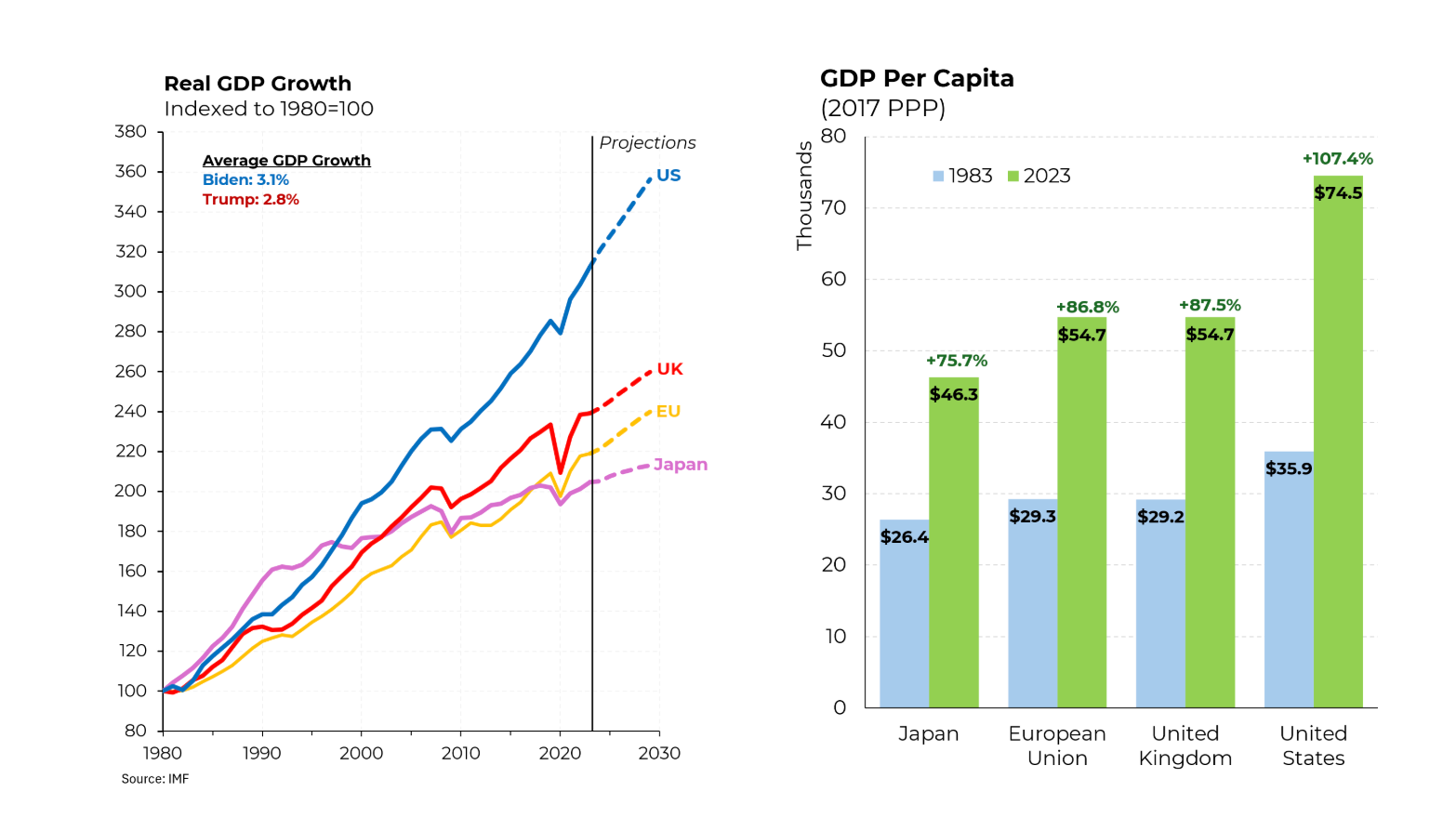

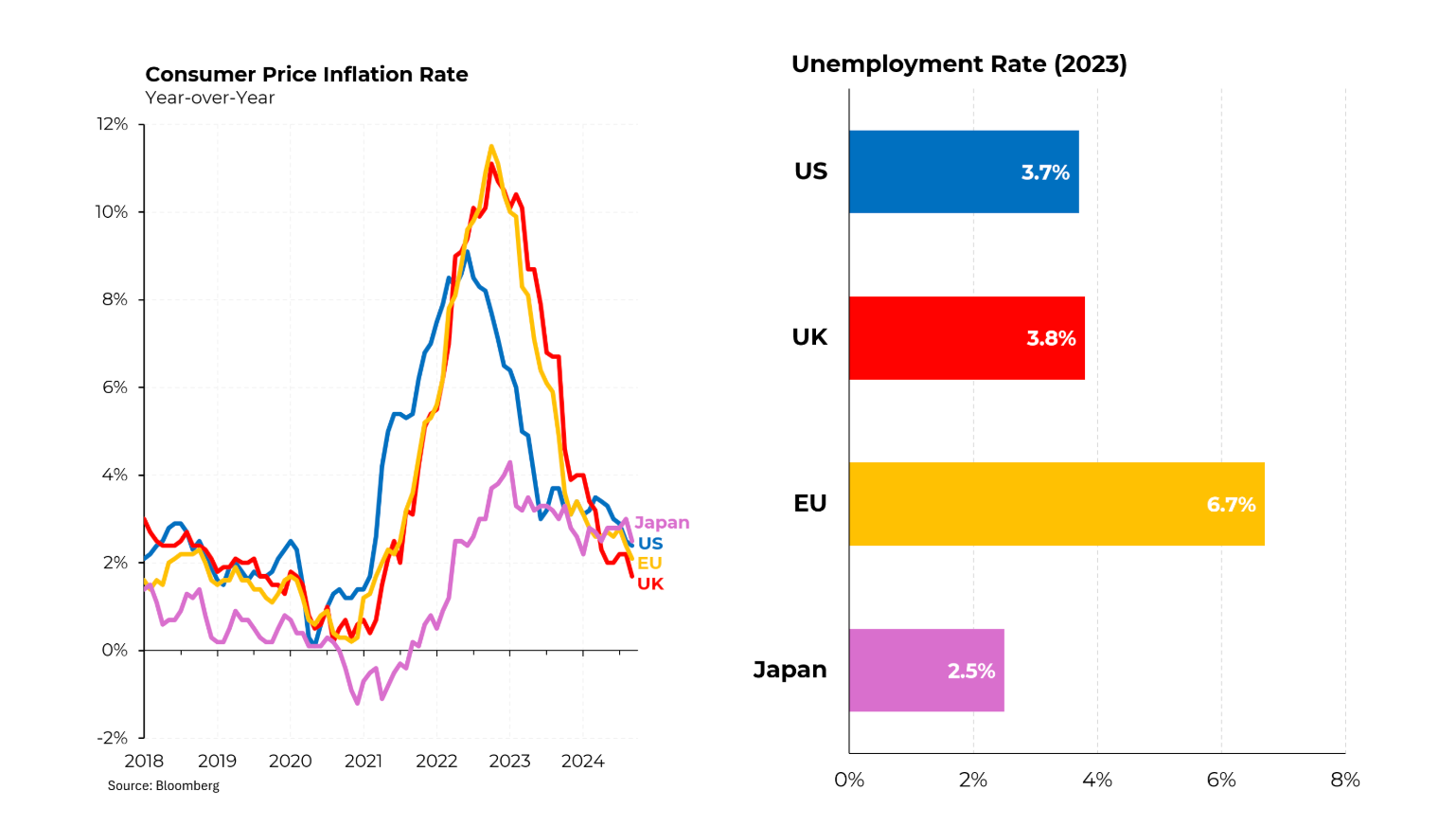

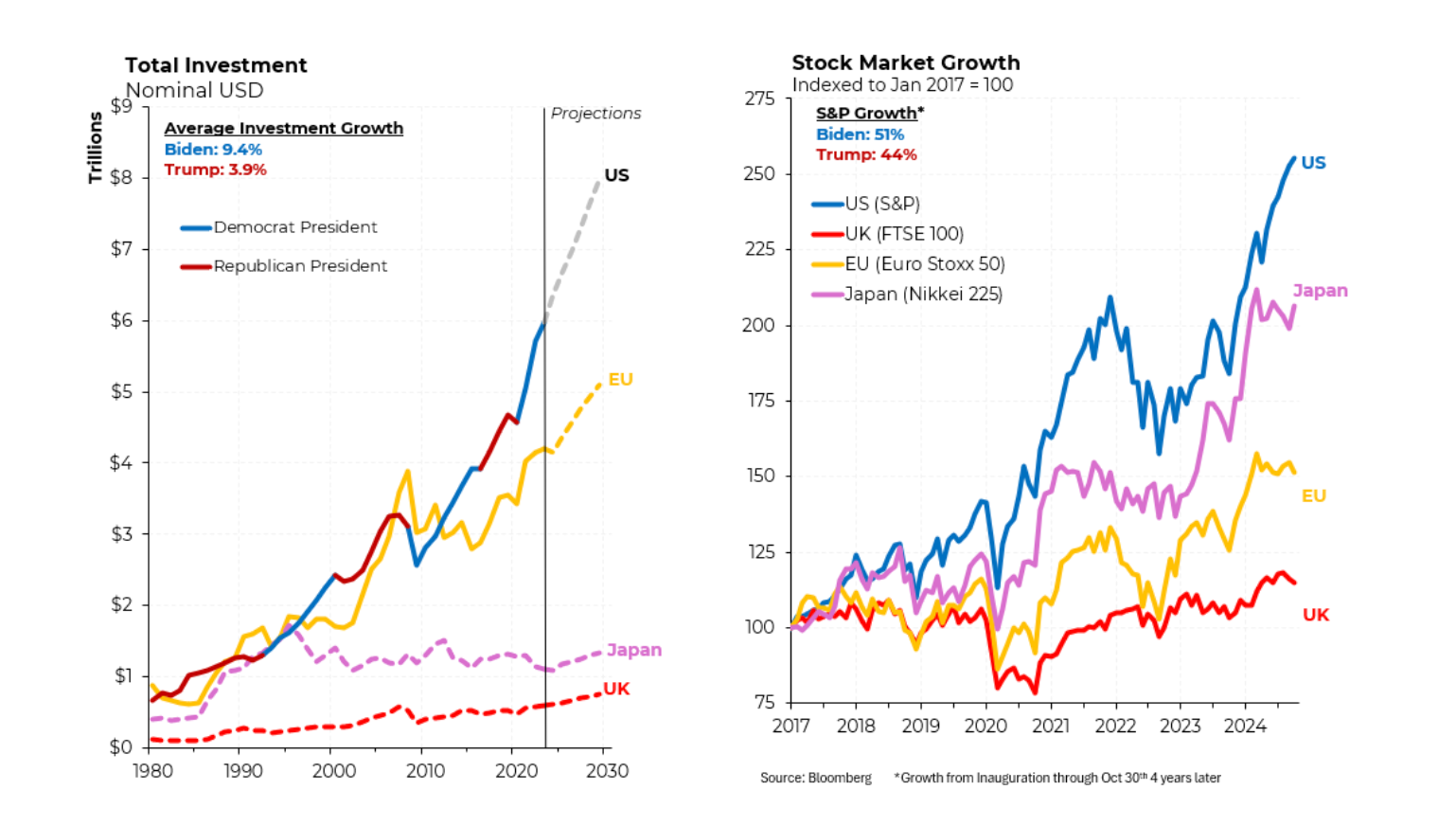

Steve Rattner, Morning Joe's Economic Analyst, highlighted "America’s Exceptional Economy" in six charts:

And Biden continued to deliver in the final two months of 2024.

November's employment gains were just revised up from 212,000 to 261,000, and December's from 256,000 to 307,000.

In January, hiring slowed abruptly

The jobs report released on February 7 showed that U.S. employers added just 143,000 jobs—significantly below the 170,000 economists had anticipated.

According to one business expert, 143,000 jobs is "not a good sign & we could be facing another recession."

Stocks slumped on the dismal news—and markets ended the week on the downside, further depressed by expectations that:

Trump’s tariffs on imports and the deportations of immigrants who lack permanent legal status – a program that would constrain the labor supply and drive up wages – could force the Fed to pause its rate cuts for an extended period.

Despite Trump's campaign promises of a "booming economy," so far he has only succeeded in fueling uncertainty, exacerbating inflationary pressures, and weakening consumer and business sentiment.

On Sunday, Trump announced new tariffs on all steel and aluminum imports, "kneecapping" his own “national energy emergency” and turning his "pledge to expand infrastructure" into yet another Trump infrastructure punchline.

He also warned Canada and Mexico that broad 25% tariffs could still begin March 1.

Trump Tariffs would weaken all three North American economies and cost the US as many as 400,000 jobs if Canada and Mexico retaliate.

Is another "Trump Crash" looming?

Warning signs of a recession are already flashing red.

According to USA Today:

Trump’s policies – combined with a labor market that’s downshifting after a post-pandemic surge – are likely to slow average monthly job gains to about 100,000 by the end of the year, Moody’s Analytics estimates.

Business leaders are bracing for continued uncertainty. The economy is teetering on the edge of a downturn.

As the economy slows, the very people Trump promised to uplift—middle-class workers and small business owners—will bear the brunt of his economic mismanagement.

Meanwhile, the tech industry is already slashing thousands of jobs that companies believe can be handled by AI.

Similar job losses will follow in sectors like finance, retail, and manufacturing.

Hiring freezes—or layoffs—will soon become the new normal throughout the economy.

Trump will make everything worse

It only took three weeks of Trump stupidity, but consumer sentiment is plummeting, job growth is slowing, and inflationary pressures are mounting.

The price of eggs is still soaring.

In healthcare, Trump has already taken actions—from imposing new tariffs on China to halting Biden's efforts to reduce drug prices—that will needlessly increase Americans' medical costs.

In financial services, by shuttering the popular Consumer Financial Protection Bureau—which had given Americans $20 billion in financial relief—he's making it easier for "financial predators, scammers, and crooks" to rip people off.

The Trump Economy is off to a terrible start. Trump's erratic policy shifts, protectionist trade measures, and reckless fiscal policies—including unfunded tax cuts for the wealthy—will only make things worse in the weeks and months ahead.

According to Andy Serwer in Barron's, a Trump recession "could be coming this year."

The stock market could be in for an even bigger shock

Business Insider notes that "fears of a stock market correction are growing on Wall Street, especially as traders eye the risk of higher inflation and more debt turmoil."

Rockefeller International Chairman Ruchir Sharma warns that "momentum investing looks poised to crash in a way that could hit many investors hard."

In Trump's first term, three years of failed policies created a house of cards that collapsed as soon as it was obvious how badly Trump had bungled the pandemic response.

Trump turned 2020 into the worst year ever for the US economy.

Don't be surprised if the next Trump Crash happens more suddenly—and is even worse.

Thanks for reading! While paid subscriptions (billed to TLD Media LLC) and one-time tips are always welcome, all content to this ad-free newsletter is free, so subscribe for $0 and you won’t miss anything. And feel free to share this content knowing there’s never a paywall!

P.S. This really is the time to get off X once and for all. Please find me on Bluesky and these other places.

Subscribe to Unprecedented

Subscribe to the newsletter and unlock access to member-only content.